More unicorn companies are choosing IPOs. Why? Why now? And what should they be doing to prepare?

Ancient Greeks and Romans once described unicorns as incredibly fast and light on their feet, with a horn that was highly prized by merchants and investors. It’s a characterization that can also be attributed to today’s unicorn companies. These privately held companies have been in business for less than 10 years. Yet, they have already reached the US$1b threshold. Most often, they’ve done it by being disruptors — turning markets, or entire industries, on their heads.

The path to unicorn status may vary for each founder and company, but eventually, they all reach an exciting but profoundly challenging milestone: the moment at which the founder must consider the company’s funding and exit options.

For unicorn companies, the options are many, the choices complex

For many unicorn companies, the decision to stay private, sell or go public is often multifaceted.

Stay private. Staying private is enticing for many founders of unicorn companies. With lots of liquidity still in the market and more investors willing to pour increasing sums of money into unicorns, founders may prefer to keep their autonomy and their companies out of the eye of the public glare. However, staying private may also mean limiting the company’s future growth. Additionally, unicorn companies will at some point have to provide a return on investment to their financial partners.

Look for a buyer. When staying private is no longer an option, some fast-moving unicorns may opt for acquisition rather than IPO. Finding an incumbent with deep pockets and scale allows unicorn companies to reach their growth potential faster than trying to build it themselves. The downside, for founders in particular, is that the entrepreneurial spirit that allowed the company to flourish can be quashed amid the lumbering pace and bureaucracy inherent within most large organizations.

Issue an IPO. The primary advantage of an IPO is that it can provide access to capital in quantities that unicorn companies can’t find elsewhere. It also gives unicorn companies and their founders an opportunity to reward and retain the talent that has been critical to their success so far. It gives investors an opportunity to realize a return on their investment, and can boost brand profile and open up markets for new customers. It demands a governance structure and level of professionalism that credentializes the company as a legitimate force in the market. However, it also invites a new level of scrutiny from investors and regulators that unicorn companies may not be prepared for.

Undertake a direct listing as another way of going public. A direct listing offers unicorns an alternative strategic route to public markets. Unicorns can directly list existing shares without issuing new shares. However, a direct listing isn’t for everyone. Size really matters. A direct listing can work well for disruptors that already enjoy brand recognition and a significant private market valuation — like unicorns. A direct listing can further strengthen a brand and build confidence in the unicorn’s equity story. It also has the option of taking the second step of issuing new shares to raise further capital.

Unicorn IPOs are on the rise, both in numbers and in value

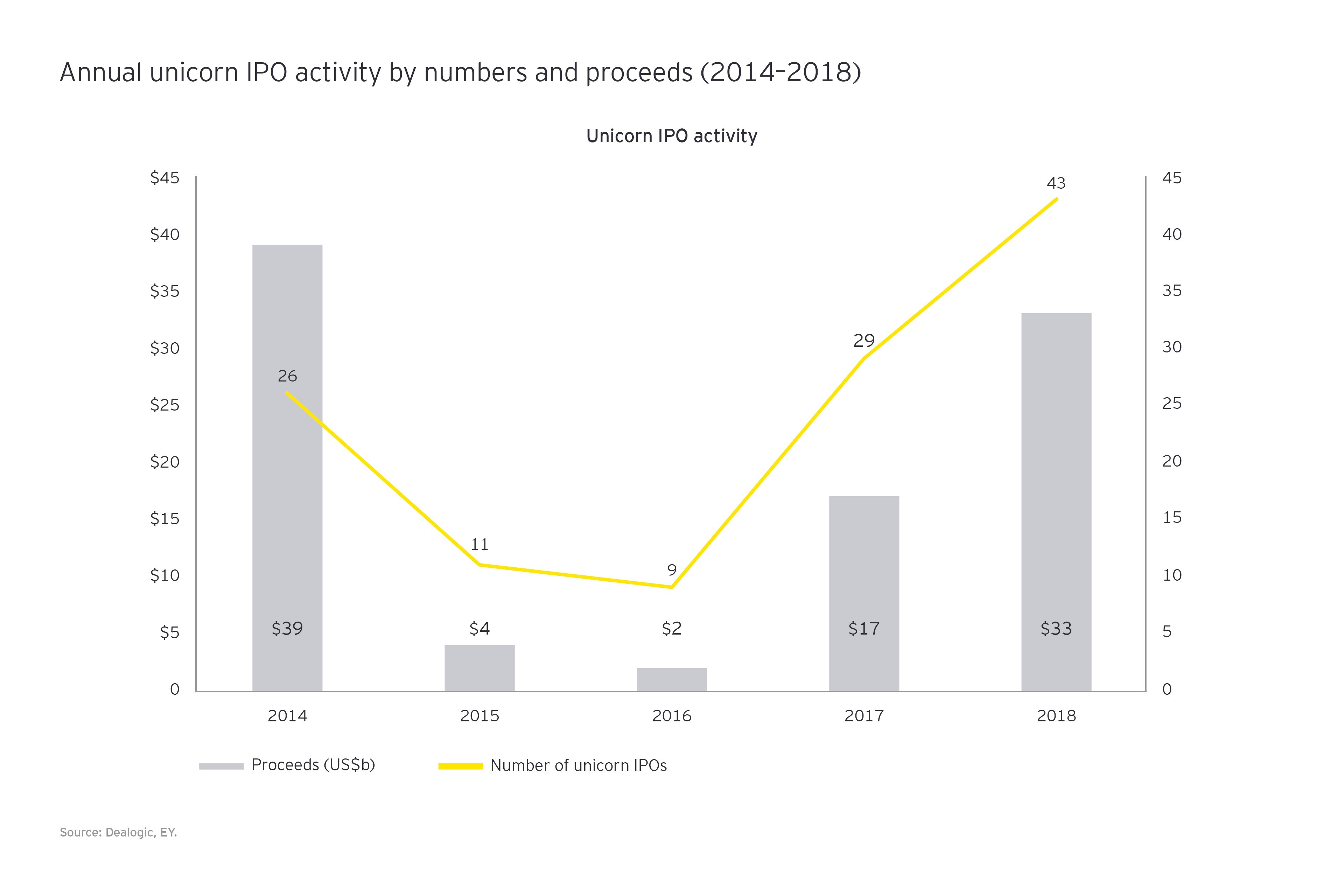

Since only a handful (they can literally be counted on one hand) of unicorn companies are positioned to even consider direct listing, a significant number have opted to issue an IPO. Between 2014 and year-to-date 2018, 103 unicorn companies have successfully issued IPOs, with total values exceeding US$80b.

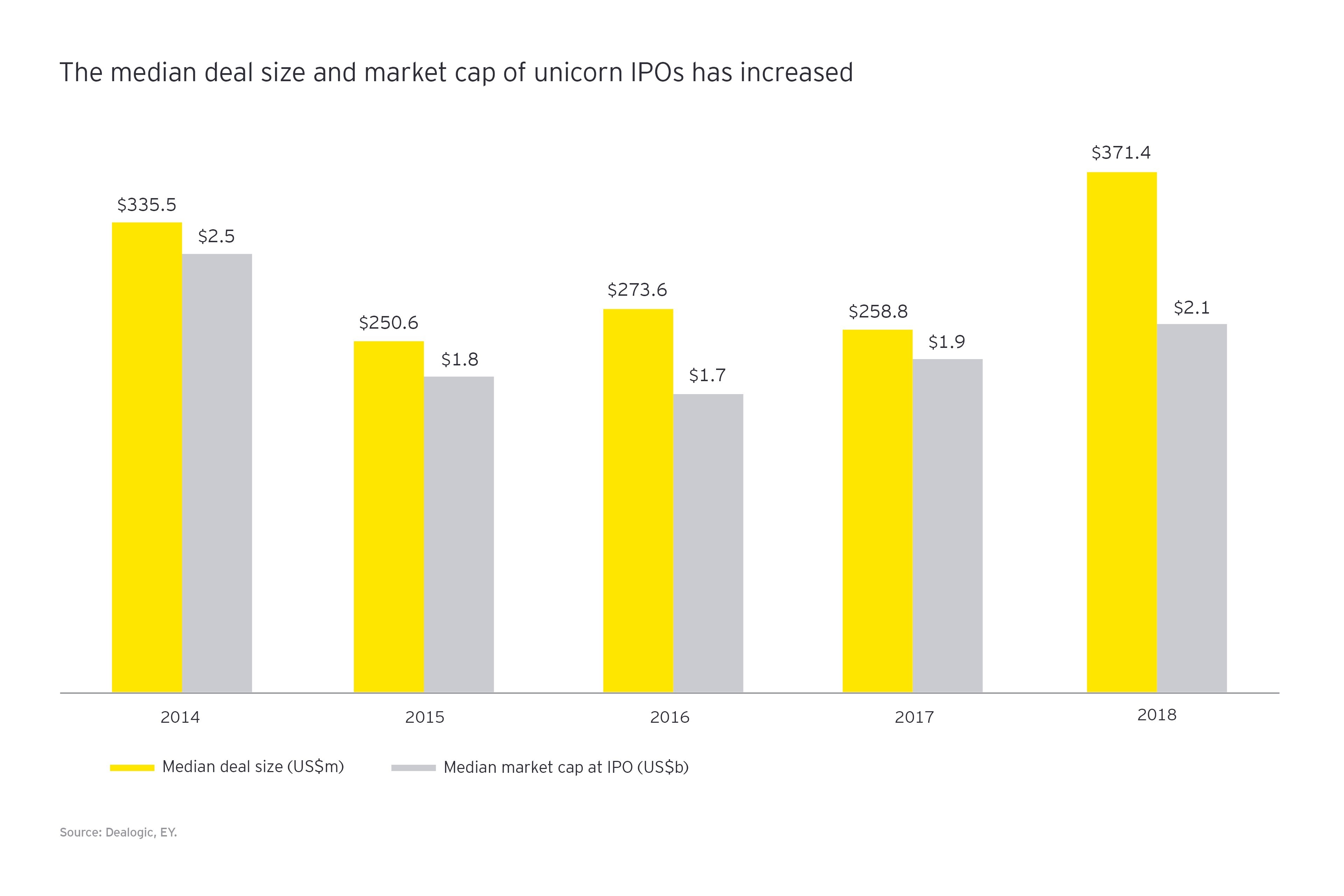

More are on their way, and, for the most part, they’re getting bigger as they go. Thirty-three unicorns have issued IPOs year-to-date 2018, the highest number on record and up from a record-setting 27 in 2017. The median deal size of unicorn IPOs also increased substantially from 2017 to year-to-date 2018, from US$254m to US$417m.

A new high for unicorns: 33 unicorns have issued IPOs so far in 2018, up from 27 in 2017.

Two reasons why more unicorns are choosing the IPO value journey

Of all the drivers pushing unicorn companies toward an IPO in the next 12 months, there are two that stand out: the pragmatism of economics and the passion of personal achievement.

Unicorn companies want to take advantage of rich pools of capital and liquidity before they dry up

If we take the macroeconomic landscape at face value, we see a world awash in capital and liquidity, and interest rates remain low for now. With so much cheap money still floating out there, it seems almost illogical that a record number of unicorn companies would feel the rush to go public. Yet, there are concerns that ongoing geopolitical uncertainties in many markets may finally take their toll on the global economy and IPO sentiment. A slowdown in economic growth, combined with an increase in interest rates, could suck the liquidity from the market and lower IPO valuations. Unicorn companies want to have an opportunity to drink from the liquidity pool before it dries up. As such, we may see unicorn IPOs set another record in 2019 before declining if the economy cools.

Founders want to join the exclusive listed global tech club

Although economic considerations are both tangible and compelling, the more intangible driver of passion is a powerful force that few openly discuss. It strikes at the very heart of what it means and what it takes to be a successful entrepreneur.

There are many logical reasons why unicorns choose an IPO — brand, talent, funding. But never underestimate the power of passion in a unicorn company's decision-making. Passion drives founders to pursue their ideas, even when everyone is saying they’re crazy, it couldn’t possibly work or that no one has done anything like it before. It gives them the confidence and unwavering conviction that their idea, product or service can change the way people think or feel or do. It also shapes how they make decisions. And what they define as personal achievement.

When founders get to the IPO stage, money is rarely the driving factor. They may want to diversify their wealth, but at its heart, founders want to reach that next personal milestone: joining the exclusive club of listed global tech companies. They want to be a part of an intimate inner circle of highly successful entrepreneurs and feel the adrenaline rush that comes with ringing the bell on the floor of the stock exchange.

There are many logical reasons why unicorns choose an IPO — brand, talent, funding. But never underestimate the power of passion in a unicorn company’s decision-making.

Is an IPO the right strategic option?

Because the reasons for issuing an IPO can be as nuanced and varied as the unicorn companies themselves, it is hard to definitively measure the value of going public. If we were to look at it in purely economic terms, based on pricing and first-day performance, generally the answer would be yes.

Performance-wise, unicorn IPOs generally experience healthy first-day pops (the rise in share price from the opening to the closing bell on the first day of public trading – typically 15% to 30%).

Over the long term, success can be measured based on two factors: whether it realizes the initial personal objectives of the founder, and whether it creates value for the company’s stakeholders. The former is easy to measure. In terms of the latter, IPO investors will measure value creation based on the promises made at the time of the IPO, the effective use of IPO proceeds and the confidence and performance of management, which in turn determines stock price. Additional performance measures, such as an increase in brand recognition, improved attractiveness for talent or the achievement of stated growth rates, will also inform the perceived value of an IP.

Five tips that can help unicorns prepare for an IPO long before the opening bell

So, how can unicorn companies improve the likelihood that their choice of pursing an IPO is as successful as possible, regardless of reason? Here are five tips.

1. Start early and think strategically

Even though the median age of a unicorn at the time of its IPO is 8 to 10 years, many companies begin to think about their IPO strategy 3 years after founding. It’s never too early to think about transaction optionality at every point in the company’s evolution. In the early days, many companies are relying on friends and family, then an angel investor and then venture capital. However, once you reach the next level of funding, private equity, the company has reached a place where investors will want to see a return on their investment. The earlier a unicorn starts laying the foundation for the possibility of an acquisition or IPO, the better.

2. Stay flexible

It’s important to stay flexible when it comes to transaction options and timing, especially in unpredictable and more volatile markets. Getting IPO-ready 12 to 24 months pre-IPO, while multi-tracking to prepare for all options, allows the company to choose the time and approach that will net the company maximum advantage.

3. Invest in infrastructure, people and processes

It’s possibly one of the least sexy parts of building a business, but at a certain point, unicorns have to invest in infrastructure, people and processes to achieve IPO readiness and provide transaction optionality.

Founders often have alpha personalities, which propels them to operate at a speed at which few can keep up. Having the right people and processes in place will help the company, and the people who support it, maintain the pace the leader sets.

4. Hire the right advisors

Having the right people inside is critical, but a strong unicorn company also needs a network of advisors to help the company stay on track. Bankers, auditors, IPO-readiness advisors, lawyers and PR consultants can offer much-needed advice at pivotal points in the lead up to and follow-through of an IPO.

5. Consider enticing key investors for reference selling

Reputation and trust are everything, before, during and after an IPO. Welcoming a special type of investor can lend credibility to the unicorn, especially in the early years.

A unicorn company starts with the passion and dream of its founder. Through confidence, perseverance, determination and money, that dream grows from a home office, basement or garage, into a US$1b reality. Speed, timing, money, passion and a host of other drivers play a role in determining which funding route a unicorn company chooses. Regardless of the reason for pursuing an IPO, whether economic or personal, it’s never too early to prepare for the pivotal milestone founders dream of from day-one.

Over the long term, success can be measured based on two factors: whether it realizes the initial personal objectives of the founder, and whether it creates value for the company’s stakeholders.

The pros and cons of issuing an IPO

If we weigh the pros against the cons of issuing an IPO, there appears to be obvious merit in taking a unicorn public; however, doing so may have its pitfalls.

Pros

- Serves as a catalyst with speed and scale for accelerated growth

- Opens access to growth capital availability and a new external investor base

- Offers a liquid market for exits of initial investors, as well as further wealth creation and diversification

- Gives a boost to brand profile and allows the unicorn to open new markets and attract new customers

- Helps to retain great talent

- Provides stronger governance and transparency, allowing the company to improve its professionalism and credentialize itself as a bona fide market player

Cons

- Invites greater scrutiny through increased transparency and capital market regulation

- Creates susceptible to volatility in the markets, which can impact value

- Increases the burden on scarce resources to meet compliance requirements and regulatory oversight

- Places pressure on the company to deliver on promises in the public spotlight

Summary

Unicorn IPOs are on the rise as companies look to take advantage of a world currently flush with liquidity. Those who do make the strategic choice to go public have some best practices at their disposal to drive them toward success.

Martin Steinbach

EY EMEIA IPO Leader

Over 20 years of experience in the corporate finance field: IPO, M&A, private equity, venture capital and mezzanine finance. IPO thought leader.